A market represents the demand side of economic activity (buyers). An ‘industry’ represents the supply side of economic activity (sellers). The intent of Part – 1 is to introduce the drone industry to the research by Professors' Fernando F. Suarez, Stine Grodal, and Aleksios Gotsopoulos. Through this research, we gain a much clearer comprehension of how new product categories emerge and how new [technology] industries are formed. While Part – 1 may feel slightly academic, it sets up the context for Part 2, which provides an insightful perspective of the drone industry. Part – 2 applies this research to the drone industry along with a novel theory [of my own] describing its evolution. The intent is to instigate healthy conversations within the drone industry.

Every company small or large entering into a nascent industry, including Venture Capital (VC) and Corporate Venture Capital (CVC), should understand the research highlighted in Part-1.

__________________________________________________________

Is past prologue?

The drone industry stands at the intersection of innovation and practicality, revolutionizing various sectors with its unprecedented capabilities. From delivering medical supplies to remote areas to capturing breathtaking aerial footage, drones are transforming our perception of what is possible. This rapidly evolving industry not only showcases the power of advanced technology but also highlights the endless potential for creative applications across diverse fields.

I’ve attended several industry events over the past few years, where it's not uncommon to hear industry insiders remark that the drone industry behaves like a technology industry. This observation is more than a passing comment; it captures a fundamental truth about the trajectory and dynamics of the drone market.

A drone is a fusion of aviation and technology, combining the principles of flight with advanced technological capabilities. The industry itself can't be neatly categorized as exclusively one or the other because it encompasses elements from both.

I’ve come to formulate a novel theory that the drone industry is mirroring the development of the Personal Computer (PC) industry in remarkable ways. Some of this is based on my own professional experience having been part of both industries at almost the exact same time in their evolution. The journey of the drone industry is still emerging, and if the history of personal computers is any indication, the future is bound to be thrilling.

I believe this theory is more than just intellectually stimulating. If my insight is correct, the drone industry has the potential to avoid the historical pitfalls of the PC industry by learning from its predecessor's experiences. It might be the first time in history when an industry has a window into its future. If my theory is correct, the drone industry could redefine "what's past is not prologue."

Assigning an age to the drone industry

A specific event can demarcate the age of an industry, or it can be revealed through historical analysis. These events or milestones frequently mark the beginning of new eras or revolutions in various industries.

- The Industrial Revolution is commonly marked by the invention of the steam engine.

- The Space Age is considered to have begun with the launch of Sputnik 1 by the Soviet Union in 1957.

- The PC revolution is often cited as beginning in April 1977 at the first West Coast Computer Faire. The Apple II, Tandy TRS-80, and Commodore PET all saw their debut at this event.

- The release of the first iPhone by Apple in 2007 is often seen as the beginning of the Smartphone era.

To explore my theory, I needed to establish an age for the industry. I chose the Federal Aviation Administration’s (FAA) Modernization and Reform Act of 2012 (FMRA) as a demarcation, giving the drone industry an approximate age of 12-years old. FMRA was pivotal legislation that set the stage for the integration of drones into the national airspace system (NAS), promoting innovation and growth in the drone industry while ensuring safety and addressing privacy concerns.

(NOTE: Juan Plaza’s article in Commercial UAV News stated the industry is 11-years old”5)

PC and drone industries had similar beginnings

The evolution of drones from larger aircraft parallels the evolution of PCs from mainframes. The first drones were large, complex machines primarily used for military purposes. Just as PCs revolutionized computing by making it affordable and accessible to everyone, drones have lowered the barriers to entry for aerial activities. Miniaturization has played a pivotal role in transforming both industries from specialized, large-scale machines to widely accessible and versatile tools, empowering the masses to utilize capabilities that were once exclusive to large, resource-rich organizations.

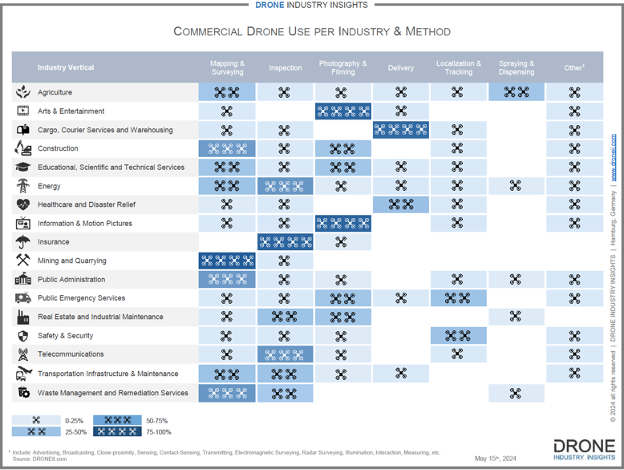

While attending an industry event, Jon Damush, CEO of uAvionix once said to me, “Drones are a way of democratizing flight.” Figure – 1 was created by Drone Industry Insights (DII).3 The infographic was designed to help visualize the pervasiveness of drones across multiple industries and their many uses. This is what democratization of flight looks like in an emerging industry. Jon Damush was correct!

The essential role of hobbyists in the PC and drone industries

The role of hobbyists in the early development and popularization of both the PC and drone industries has been pivotal, with enthusiasts driving innovation, creating communities/clubs/local events, and pushing the boundaries of what these technologies could achieve. Hobbyists are considered the innovators and early adopters for both technologies. They provided the early market validation and community support that helped these technologies evolve and eventually ‘cross the chasm’ into mainstream adoption.7

PC and drone industries are umbrella labels

As the drone industry emerges, the pace of innovation and the surge of new entrants create a vast and complex landscape of products and services. I refer to this as "category chaos." Organizing an industry into logical groupings is crucial for making sense of the landscape, identifying key players, and understanding market dynamics.

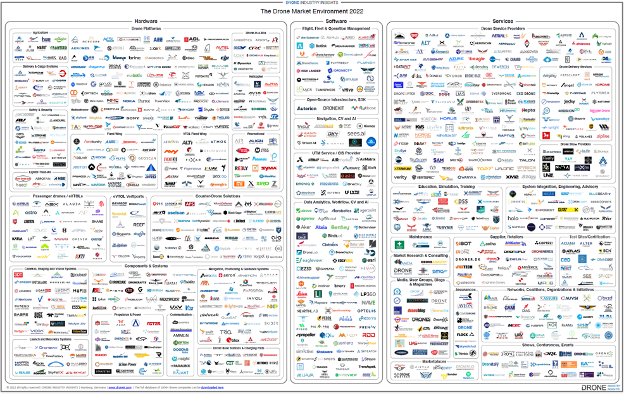

This is the value provided by DII’s graphical representation of the drone industry shown in Figure – 2.1

Notice how DII smartly categorized the industry into three segments: hardware, software, and services; and then into sub-categories. Like the PC industry in its early years, the drone industry is composed of almost entirely emerging categories striving to become industries. Both the PC and drone industry are what I refer to as an ‘umbrella’ label. This is the top-level label for an industry with sub-categories.

PC and drone industries are served by thriving ecosystems

Both industries, in their early stages, saw a proliferation of companies providing a wide array of products and services aimed at extending the capabilities of the core technology. The growth of these ecosystems created a robust market fostering healthy competition and innovation. As shown in Figure – 2, the drone industry is a thriving ecosystem of technologies and services, most of which are still emerging.

The design of the PC in its early days was centered around modularity and expandability. It provided expansion slots and standardized ports which allowed the end user to enhance its capability. Back in the day, if you were a gamer, you would have added a Sound Blaster (PC) or Mockingboard (Apple II) to your computer to enhance its audio capabilities (e.g., create music, sound effects, etc.). While expansion slots are still available, especially in desktop computers, there are several standardized ports (e.g., USB, HDMI, etc.) to connect a variety of peripheral devices to a PC.

Drones too are designed with modularity and expandability in mind. Users can swap out cameras, batteries, sensors, communication devices, and other payloads to suit different missions. As an example, maintaining communication between a drone and its operator is a complex challenge, particularly over long distances as in the case with beyond visual line of sight (BVLOS). To expand a drone's communication capabilities, you can mount the Elsight’s Halo device to a drone. The Halo delivers continuous coverage across a variety of different technologies like 4GLTE/5G, local RF, satellite, and more. The physical data connection is typically USB or ethernet.

In terms of standardized ports on a drone, connectivity options will vary depending on the manufacturer, model, and intended use of the drone. Standards take time, and drones still have many years of catching up to do relative to the PC.

PC and drone industries embed many of their ecosystem technologies

As the PC industry matured, numerous technologies that were once separate peripherals or add-on cards were embedded directly into the motherboard or became standard features of PCs. The audio features once provided by dedicated sound cards like the Sound Blaster have largely been integrated into modern motherboards. There are numerous other technologies that were integrated into the PC like networking capabilities (e.g., Ethernet and Wi-Fi), communication ports (e.g., USB), peripheral interfaces (e.g., Bluetooth), and security features (e.g., fingerprint and facial recognition) to name a few.

Some of the newer integrations include Artificial Intelligence (AI) integrated into microprocessors. The integration of AI into microprocessors, exemplified by Nvidia’s advancements, is transforming personal computing.

Like the PC, as the drone industry matures, various technologies that were once separate add-ons or external components are also being embedded directly into drones. It is not difficult to imagine that something like Elsight’s Halo could one day become a standard technology embedded directly into drones.

Other key technologies already integrated into drones include: navigation and positioning systems (GPS, IMUs), communication systems (radio transmitters and receivers, 4G/5G modules), sensors and cameras (high-res cameras, LiDAR, infrared Sensors, multispectral), obstacle avoidance (ultrasonic, stereo vision), flight control systems (autopilot systems), power management (BMS, solar panels), data storage (integrated memory, SSDs, SD cards), and security (encrypted communication, geofencing). Lastly, drones are increasingly incorporating AI processors to enable real-time data processing and decision-making, such as object recognition, flight path optimization, and adaptive learning from the environment.

The integration of these technologies has made PCs and drones more versatile, efficient, and accessible, catering to a wide range of commercial, industrial, and recreational applications. The development of a robust ecosystem surrounding each of these technologies have been critical to the continued development and success for both industries.

The impact of regulations on an emerging industry

In highly regulated industries, the primary issue often cited is that there are too many regulations. Conversely, the drone industry faces the challenge of under-regulation, though the effects are largely the same. The industry will never realize its full potential until routine, large-scale BVLOS operations are enabled. Fortunately, the FAA's Reauthorization Act was signed into law on May 15th, 2024, giving the federal agency a clear deadline to release a preliminary BVLOS regulation within four months.

Well-designed regulations will help break this vicious cycle and build public trust for drone technology by addressing concerns related to safety, privacy, security, and noise pollution. Clear regulations will stimulate market demand, attract investment, and foster innovation.

Applying the research to the drone industry

Part – 1 introduced the research by Professors' Suarez, Grodal, and Gotsopoulos. Drawing from that research along with DII’s infographics, and my own personal insights into the industry, I have reached the following conclusions.1&4

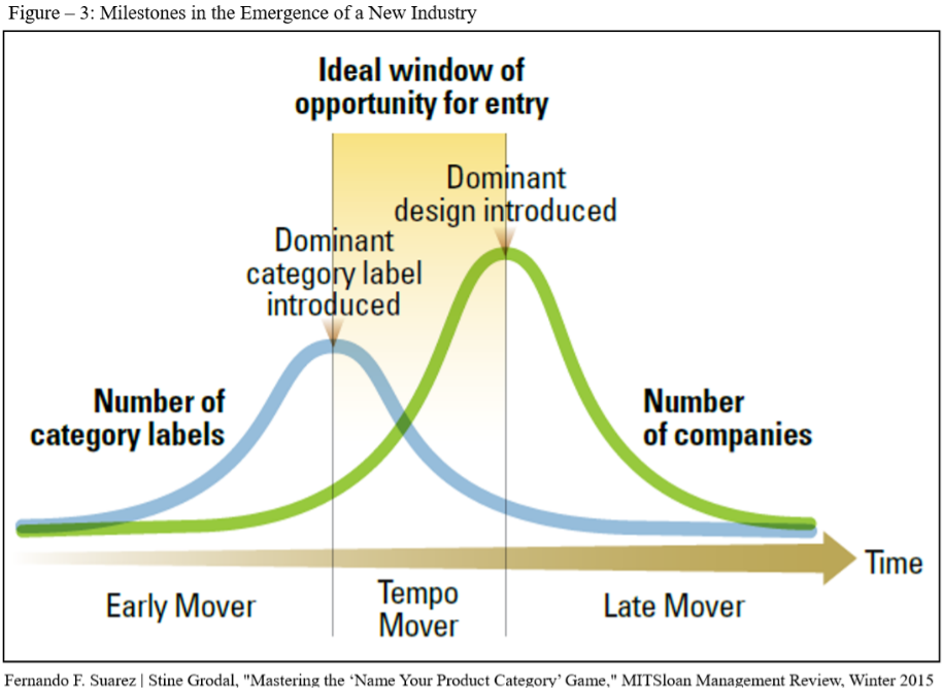

All three segments of the drone industry (hardware, software, and services) are emerging at the same time, though the hardware segment is the most mature, containing the majority of the dominant category labels. As shown in Figure – 3, each emerging category in each segment will experience these dynamics.6 The industry's expanse reveals that while hardware leads the way in early innovation, software and services will gradually catch up as the ecosystem matures. There are however exceptions to these dynamics such as "UAS Traffic Management" (UTM).

All three segments of the drone industry (hardware, software, and services) are emerging at the same time, though the hardware segment is the most mature, containing the majority of the dominant category labels. As shown in Figure – 3, each emerging category in each segment will experience these dynamics.6 The industry's expanse reveals that while hardware leads the way in early innovation, software and services will gradually catch up as the ecosystem matures. There are however exceptions to these dynamics such as "UAS Traffic Management" (UTM).- In an industry where hardware, software, and services are all emerging simultaneously, several complications can arise due to the interconnected and interdependent nature of these segments.

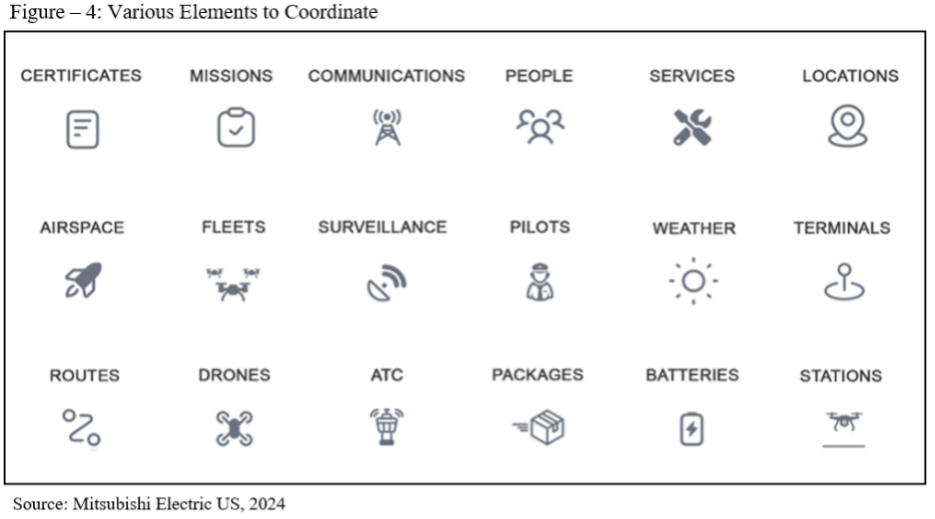

Figure – 4 illustrates that even a single mission can require the careful coordination of various technologies, services, and stakeholders to achieve safe and efficient operations. To operate at scale, the interconnectedness of these elements’ drives the need for a robust ecosystem where each segment supports and enhances the others, ensuring reliable and advanced performance.

Figure – 4 illustrates that even a single mission can require the careful coordination of various technologies, services, and stakeholders to achieve safe and efficient operations. To operate at scale, the interconnectedness of these elements’ drives the need for a robust ecosystem where each segment supports and enhances the others, ensuring reliable and advanced performance. - There is no evidence that any category has a dominant design. Developing and establishing standards and norms typically takes considerable time. No large brand has entered the market setting a hardware standard as in the case with IBM (PC) and Apple (Smartphone) in their respective industries.

- As shown in Figure – 3, the research tells us that the ideal window of opportunity (e.g., Tempo Mover) when entering an emerging industry is the time period between the introduction of the dominant category label and the introduction of the dominant design.6 Big brands entering into the hardware segment still have their best shot at succeeding in these new markets as evident with IBM (PC) and Apple (Smartphone). Both companies entered the market after the dominant category label was established and created the dominant design.

- Drones are now available in a variety of retail settings, from specialized hobby stores to big-box retailers and online marketplaces like Amazon. Drones for recreational use have largely become a commodity. DJI is the one brand that stands out for recreational and commercial use.

- The research suggests that when creating a new category label, it should be both "novel and familiar."6 A label should be distinctive enough to attract attention, yet familiar enough to convey how it will be used. There are some good examples of these labels within the hardware segment such as "Drone-in-a-Box" and "Drone-as-First-Responder (DFR)." One such label that does not meet the criteria is "Counter-Drone." While this is a mature label, it is neither novel or familiar. It will be the job of Product Marketers to infuse this label with a clear meaning.

- Well-known brands can bypass the typical industry dynamics, but it comes at a price (See Part – 1, inference #5). An example of such a label is UTM. NASA has played a pivotal role in the development and evolution of air traffic management systems for the FAA. Given NASA’s profound understanding of air traffic complexities, it was Dr. Parimal Kopardekar (a.k.a. PK) that coined the dominant category label of UTM, establishing a framework to manage the safe and efficient integration of Uncrewed Aerial Systems (UAS) into the national airspace (NAS). PK’s foresight in creating UTM was grounded in a comprehensive understanding of both the technological requirements and regulatory considerations.

Understanding the anomalies

As discussed in Part – 1, a dominant category label is "collectively created and socially negotiated."6 It can take years for the dominant category label to emerge. Once affirmed, users know what to expect from a product in that category. This is not the case with UTM.

If the label is fast-tracked as in this instance, while the industry has accepted it as the dominant category label, it can prolong the confusion to its market because the industry itself is unclear of its specific meaning and functional components. Given that the traditional industry dynamics have been sidestepped, cross-industry collaboration is vital to give the category label its definitive meaning and to clearly define the category.

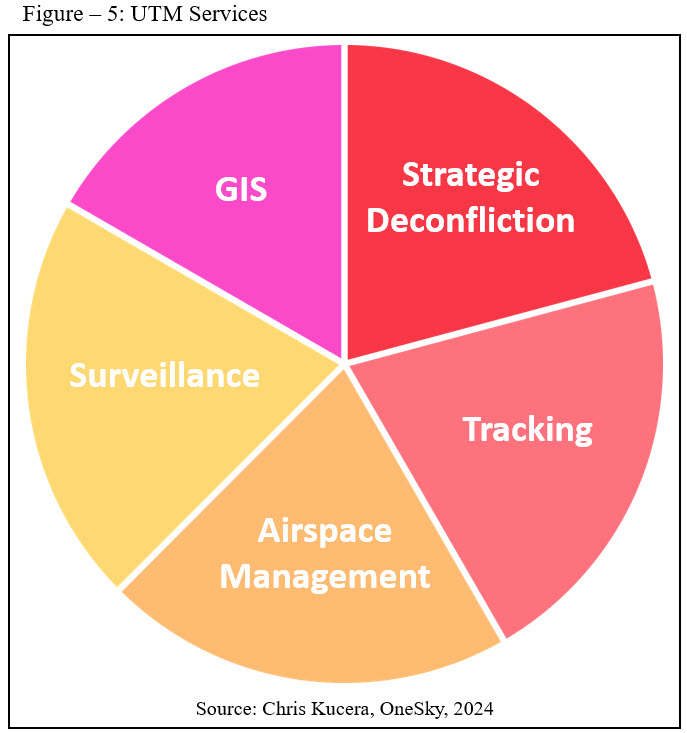

Figure – 5 highlights some of the various UTM services. UTM is one of these core BVLOS technologies where you know you need it, but you’re not quite sure what it does. What are all the functional services? Which companies offer which services? “Not one UTM company can do it on our own, we have to have help—we have to approach it as a team,” said Chris Kucera when talking about the industry.

In terms of the design, while NASA and PK play a leading role, other producers, stakeholders, and organizations like the ASTM will contribute to the development and promotion of the concept of UTM. While a standard is emerging, a dominant design will take time to emerge.

(NOTE: It’s quite possible this anomaly may have an adverse effect on the dominant design.)

There are still lessons to be learned

The drone industry’s trajectory indeed mirrors that of the PC industry in many ways. The core concept of enabling the device to do more through hardware, software, and services, the integration of diverse technologies, and the development of a supporting ecosystem are common threads in both narratives. Understanding this progression helps anticipate future trends and investments within the drone industry, emphasizing the importance of continued innovation in software and the development of comprehensive service offerings to support the growing capabilities of drone hardware.

It’s important to underscore the challenges and opportunities still on the horizon.

- The lack of regulations has limited the commercial viability of the industry. Thankfully, we can anticipate the upcoming implementation of vital regulations for BVLOS, Part 108, and beyond.

- While drones are specialized in their ability to fly and navigate through space using specific hardware and software, at their core, they are indeed computers. They process data, execute programs, interact with users and other systems, and control hardware components. The complex interplay between hardware, software, and services in drones is critical, whereas PCs exhibit far less critical interdependence. As shown in Figure - 4, today’s drone industry is marked by a delicate balance of interdependence and interconnectedness. You must experience it to appreciate the tacit nature of the industry, its technologies, and stakeholders. Addressing these complications requires a strategic approach that includes fostering collaboration across the entire drone industry.

- The drone industry has yet to experience its “internet moment.” The development and widespread adoption of the internet in the mid-1990s revolutionized the PC industry. The internet provided the infrastructure to network PCs to connect, share information, and access vast amounts of data, leading to exponential growth in applications, services, and overall economic impact. Similarly, the creation of the national highway system in the 1950s and 1960s provided the needed infrastructure for a reliable and extensive network for the automotive industry. This facilitated long-distance travel, boosted commerce, and led to widespread automobile ownership, profoundly impacting economic growth and societal development.

The industry's "internet moment"

The drone industry's "internet moment" could mirror the infrastructure innovations of the PC and automotive industries, blending elements of both. Drones will depend on established aerial corridors, much like highways, for navigation. Drones will require vertiports to serve as critical nodes to land, recharge, load or unload cargo, and perform maintenance. Repurposing existing infrastructure like parking lots, rooftops, and other commercial and urban spaces to accommodate new technologies (like vertiports) is a practical approach that leverages underutilized assets in densely populated areas.

Drones will require a high-level interoperability for communication, data exchange, and coordination between different types of drones, vertiports, IoT devices, regulatory bodies, and to respond dynamically to the airspace environment. It might need an entirely new type of networked infrastructure requiring new protocols and standards like what was required for the internet (TCP/IP, HTTP). Sophisticated UTM’s could serve as the backbone for the entire system.

The true potential of an industry often remains hidden until the necessary infrastructure is in place. By addressing both the connectivity and physical infrastructure needs, the drone industry can achieve its transformative internet moment, enabling widespread adoption and unlocking its full potential.

(NOTE: I recognize interoperability is a work-in-progress with entities across the industry along with NASA, ASTM, and more.)

Accelerating commercial viability and market demand

The current emphasis on national infrastructure development within the United States provides a timely and strategic opportunity to build the necessary foundation for the commercial viability of drones. By focusing on key areas such as vertiports, charging stations, maintenance hubs, communication networks, UTM systems, and regulatory frameworks, the U.S. can position itself as a leader in the drone industry, unlocking significant economic, social, and environmental benefits. Ongoing investments from the U.S. Government, such as through SMART grants and the Inflation Reduction Act, are crucial. Venture Capital (VC) and Corporate Venture Capital (CVC) should seize the opportunity and invest robustly. CVC could play an outsized role in advancing the industry because they often prioritize strategic over financial benefits.

From my analysis, it became evident that the absence of a dominant standard-setting company like IBM in the drone industry provides an opportunity for diverse innovation and specialization, helping to avoid the pitfalls of commoditization. The IBM PC's open architecture allowed other manufacturers to produce IBM-compatible PCs. This openness fostered a competitive market, leading to rapid technological advancements and a broader range of products. The standard made it easier for other companies to produce compatible hardware and software. However, this standardization also led to commoditization, resulting in intense price competition and reduced profit margins, with companies struggling to differentiate themselves.

Drone manufacturers must balance the efforts to ensure compatibility and interoperability to avoid fragmentation. By focusing on open standards, modularity, and niche markets, drone companies can leverage this dynamic to foster a vibrant, competitive, and innovative market, thus avoiding the pitfalls of commoditization. What’s past does not have to be prologue!

Both the PC and drone industries have profoundly transformed our world, driving economic growth and societal change. PCs revolutionized how we work, communicate, and access information, becoming indispensable tools in our daily lives. Similarly, drones are on the brink of redefining industries by boosting efficiency, enhancing safety, and expanding data collection capabilities.

As we embrace this new era, the potential of drones to innovate and improve our world mirrors the transformative journey of the PC, promising a future of boundless possibilities.

REFERENCES

1. Drone Industry Insights, The Drone Market Environment Map 2022, October, 2022

2. Drone Industry Insights, Drone Industry Funding through 2023, February, 2024

3. Drone Industry Insights, Commercial Drone Use, May 16, 2024

4. Drone Industry Insights, The Electric Aircraft Market Map 2024, July 2024

5. Juan Plaza, Commercial UAV News, The Uncrewed Aviation Industry is Still in its Infancy, March 22, 2024

6. Fernando F. Suarez | Stine Grodal, Mastering the ‘Name Your Product Category’ Game, MITSloan Management Review, Winter 2015

7. Geoffrey A. Moore Crossing the Chasm: Marketing and Selling High-Tech Products to Mainstream Customers. 3rd Edition, 2014

(NOTE: Dedicated to Chris Kucera, a visionary in our industry and someone I deeply admired.

Comments