Everyone who has seen a drone flying in person knows that they are a pretty awesome piece of machinery, and everyone who has worked with drones understands that they can be a revolutionary tool for carrying out certain tasks. This combination of coolness and efficiency naturally brings us to a question of how much money goes into the industry by way of investment in order to push commercial drones forward.

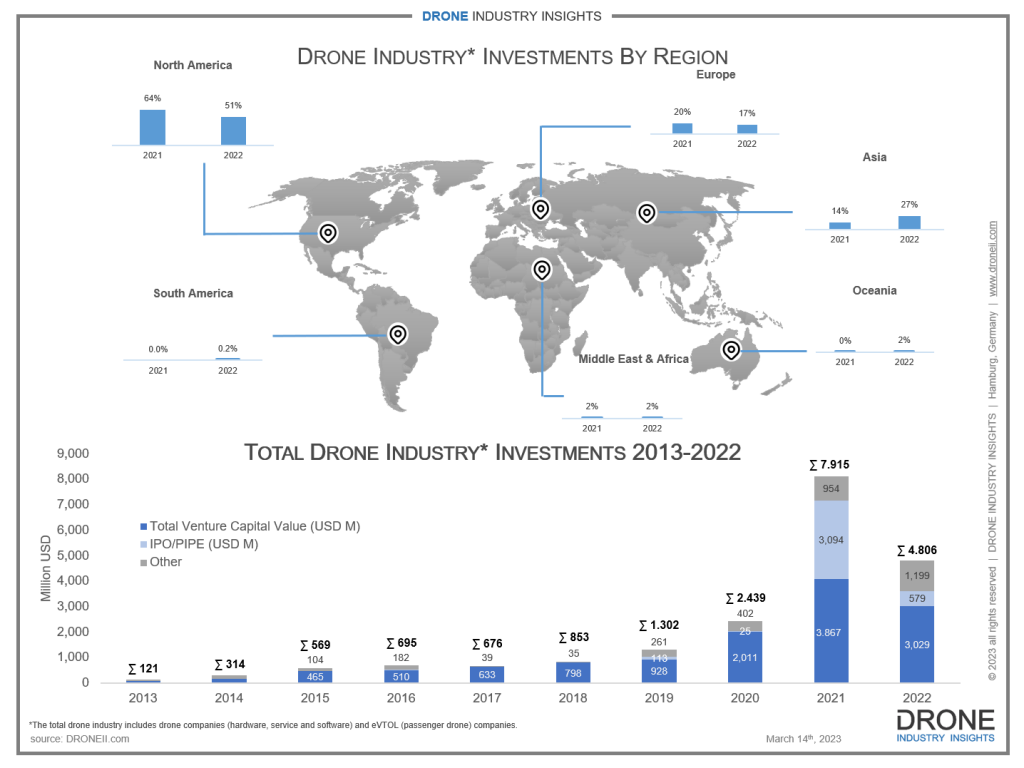

Research from Drone Industry Insights (Droneii) shows that there were 179 investment deals going into the drone industry in 2022, all of which amounted to a grand total of US$4.8 billion. This was a decrease of 39% from the record-breaking year in 2021 but nevertheless more than 2018-2020 combined. Regarding Mergers and Acquisitions (M&A), there was a rather negligible decrease, with a total of 40 deals compared to the previous year's 47 deals. Finally, the number of partnerships grew massively, rising from 193 deals in 2021 to 270 deals in 2022. Most of those partnerships were between drone companies and non-drone companies, which shows that the drone world is a multi-industry of companies working to achieve their goals more efficiently.

Geographically, North America was once again the top region for drone investments. However, there was a significant decrease in the total investment value that went there, which declined from 64% of the 2021 total to only 51% of the total value in 2022. Meanwhile, the number two and three regions swapped places from the previous year: Asia rose from 14% of investments in 2021 to 27% in 2022 and overtook Europe, who fell from 20% in 2021 to 17% in 2022. All things considered, the top three regions continue to dominate drone industry investments by taking up 95% of all investment value.

Another growing topic that Droneii’s latest report covers is drone stocks. Over the past decade or so, the number of drone companies that entered financial markets and became public has grown more and more. This is particularly the case with Advanced Air Mobility and the number of eVTOL manufacturers that started trading stock in 2021. Droneii’s report looks at stock performance throughout all of 2022 and although the market cap for most companies decreased during this period, it will be crucial to monitor drone stock performance as key regulation takes effect and more companies are able to carry out advanced operations such as BVLOS, over people or at night.

Even though 2022 was not a record-breaking year like the previous ones, the drone industry continued to receive substantial and important investments that will push commercial drones forward. With this healthy influx of investments, the continued spread of drone applications around the world, and the passing of necessary drone regulation, it is no surprise that drones are still on path to become a US$56 billion industry by 2030.

Comments