Commercial UAV News has spoken at length about the value drones can provide asset owners when conducting inspections. They take people out of dangerous situations, such as hanging off a bridge or dam; reduce the amount of time subject matter experts need to be in the field; and provide a rich dataset that can be tracked over time to detect structural changes. Much of what we’ve seen includes your standard set of sensors—Lidar, photogrammetry, and thermal—but recently, we learned that Niricson has added a new tool to their toolbox—the acoustic sensor and it is adding another level of vital data for asset owners.

Niricson is a software company that specializes in condition assessments of concrete structures. They provide actionable insights into owner’s assets by assembling a 3D model of their assets on their online digital platform. The platform provides multiple layers of actionable data, utilizing machine learning and their own patent-pending acoustic sensor techniques to detect and quantify defects. Having started with hydroelectric structures, such as spillways and dams, they have since expanded their operations to working within GPS denied environments, like bridges and tunnels.

With America's and Canada's aging infrastructure and the effects of climate change, Niricson realized that quantifying, detecting, and producing data on these structures using drone technology provided asset owners with actionable insights in a shorter timeframe and at a lower cost. In a recent bridge inspection in Atlanta Georgia, they partnered up with Pacific Triangle, a project management company specializing in remote data collection, utilizing lidar, underwater ROVs, helicopters, UAVs, and handheld cameras, to collect sensor data and conduct an acoustic hammer test.

To learn more about the bridge inspection, Niricson’s patent-pending acoustic sensor and the capabilities of their 3D modelling software, and more we spoke with Kenneth Ang, UAV/Geospatial Lead at Niricson Software Inc. and Ian Foley, CEO of Pacific Triangle.

Danielle Gagne: What kind of sensors were used during the project and how was that data collected?

Kenneth Ang: We used many different sensors, including the Skydio X2E, the Skydio X2 Color / Thermal drones, as well as Skydio's 3D SCAN for GPS denied capabilities. We also used the DJI M300 and DJI Zenmuse P1, as we wanted to go after millimeter level cracks and beyond. Then we processed the Skydio data independently in Bentley's ContextCapture to recreate a 3D model of the project. We also produced a 3D model from Zenmuse P1 and compared the two datasets. We also used our patent-pending acoustic sensor with our in-house processing techniques to perform a hammer test with a drone.

A drone conducting an acoustic hammer test is unique to Niricson. First off, what is this test and what does it test for? And secondly, what does the drone do to collect the data, especially compared to before?

The hammer test is when engineers and bridge or dam inspectors go out on a structure with a hammer and strike the concrete to understand if there's a void behind it. This tells them whether there’s an area that needs repairs or how bad of a defect there is. When we mount our sensor on a drone, we want to cover a wider area quicker than someone going out there. The places that an engineer or bridge inspector must access to conduct this test are particularly dangerous and challenging—a drone is safer and reaches areas that people can't get to. This sensor provides a lot of data to the asset owner so that they can use their rope access crew more strategically.

From the field, how long does it usually take to process the data into a useable product?

It depends on the size of the structure and the collected data size. I can go out there, collect 50 points, and it is a speedy process. On the other hand, a huge dam takes eight days to collect, and we're talking about huge datasets with one millimeter GSD that take a long time to process. So, it really depends on what the asset type is. But typically, our turnaround rate is a lot faster than having someone manually do all this stuff because our real leverage is being able to feed our 3D models to our machine learning algorithm, which gets better over time. For example, when we first started, it took 20 hours to recognize a crack or various types of cracks, and now, we've got it down to 33 seconds. As computing power and our software algorithm continues to improve, the time to process data is reduced over time, especially if we return to the same structures over and over.

Once the data is ingested onto Niricson's platform, what is the final product?

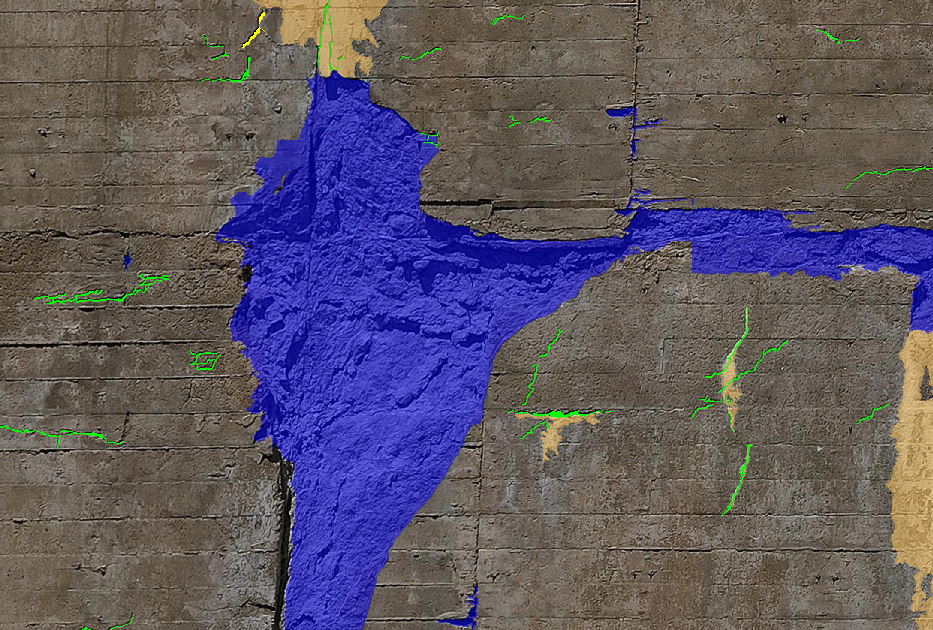

Basically, what we provide our clients is our online platform where we host the base ortho-images and a lot of actionable data layers on top of that.

For example, the customizable crack layer is color-coded to distinguish different cracks—from 0 to 5 millimeters is green, 5 to 10 is yellow, and over 10 is red. There's also a spalling, thermal, and acoustic layer that shows if there is any subsurface damage at a specific point on the structure.

Right now, we are in the process of collecting baseline data. Our objective is to provide a change detection system so clients can see how their assets are changing from year to year, detect if cracks are growing, and act upon that data.

What can the stakeholders of this project do with this data and how is that different than what they were doing? What is the value?

Essentially, once we survey and quantify the data, we then put it on an online platform and, right away, they can see exactly where they need to perform repairs without having someone go out to the asset and do the work themselves—saving time and money by enabling subject matter experts to focus on the data and use their resources more efficiently.

Can you talk about the value time saved provides clients?

Saving time on site is one obvious way that we can provide value. For example, we had a client that wanted to use rope access crews to map out cracks on a very large hydroelectric structure, and that would have taken them months. Our data collection technique cut that time down drastically to just 8-10 days onsite. In addition to that, our solution, which takes 33 seconds to detect cracks on an orthomosaic, saved them time in that aspect as well, and once the data was on our platform, it was a one-stop shop for everything they needed to see.

But the quality of data gathered is another way these processes can save time. I was a surveyor a couple of lives ago and we would hand write our field notes. We’d give them back to the office crew and they’d sometimes respond, "I can't read your drawing." So, having all this data digitized right off the bat is a hugely significant time saver.

These new data collection workflows that integrate drone technology and sophisticated software are still in its early days, there is still some hesitation to adopt this technology. What are the barriers to adoption?

We're a very young company so, the new kid on the block always has to work a bit for people to know that we exist. One of the challenges we face is to show people that the technology works, and we're in the stages of proving that. Once more people see that it works, it's going to be on a different trajectory because more people will adopt it. We aim to help the industry by providing actionable insights right off the bat.

Ian Foley: We aren’t really running into a lot of barriers. If anything, we're fortunate. Just like Niricson, we are also a young company. We're only in our fourth month and we've already done seven verticals. That's why we are so excited to work with Niricson because they've just created a new vertical. Most of us have been working a couple of years, and we've seen most of the platforms and payloads out there, so it's just an exciting time to be part of the industry.

Finally, in your opinion, where do these technology solutions fit into the future near and long term and how do we get there?

One of our main objectives is providing actionable insights. We want to give as much data as possible about the current conditions of assets and structures for the asset owners. In the short term, we want to collect as much baseline data as possible for different types of structures and get that buy-in from the industry to show them that this piece of technology is here to help and not take away jobs. Our long-term strategy would be to come back year after year to provide meaningful insights to the clients including change detection and predictive analytics, which helps them monitor the changes in the structure’s condition.

.jpeg.small.400x400.jpg)

Comments