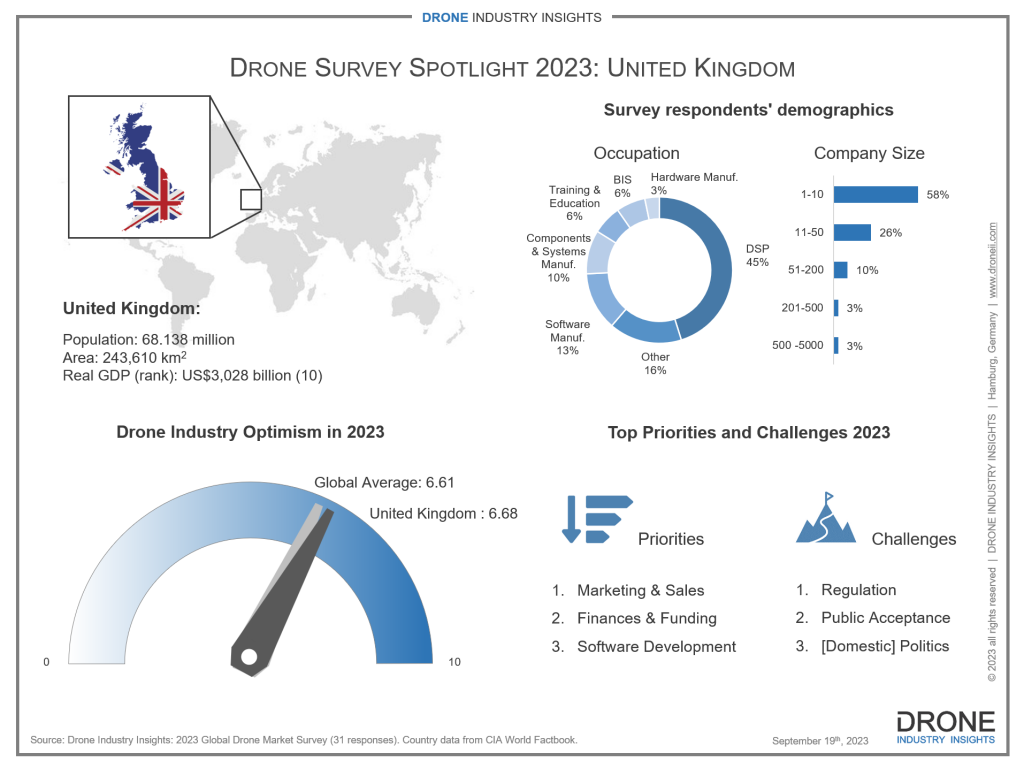

The drone market in the United Kingdom is among the top in the world, with significant potential for growth. The country's robust economy, with a real GDP of US$3 trillion, and its global influence in various fields make it an ideal environment for the drone industry to thrive. However, the industry must address challenges related to regulation, public acceptance, and domestic politics, while also fostering collaboration and innovation among its diverse range of stakeholders.

The drone industry in the UK is primarily composed of small companies, with 84% of them having fewer than 50 employees. The majority of these companies are Drone Service Providers (DSPs), with a significant presence of software manufacturers and components and systems manufacturers. Additionally, many drone operators and companies in the UK are members of a drone association, indicating a sense of community and collaboration within the industry.

In terms of company priorities, marketing and sales have become the top priority for drone companies in the UK. followed by finances and funding, and software development. This trend of prioritizing marketing is quite clear and strong in the global industry as a whole. The next top priority was funding, which is important for the large number of small companies/startups to scale their business. Lastly, the third listed priority was software, which is not surprising given the high number of drone software companies in the UK drone market.

When it comes to challenges, participants in the 2023 drone industry survey specifically mentioned several challenges, including legislative hurdles, slow processing, public acceptance, and domestic politics. These obstacles are key for the industry to thrive, particularly for BVLOS applications. However, the topic of regulation remains the most crucial one, especially after respondents stated that they didn't see significant regulatory changes.

In 2022, the UK was ranked at the top of the regulatory Drone Readiness Index alongside Australia. This ranking would likely not sit so well with the UK drone companies who see regulation as a challenge and are eager to do more. However, it is worth noting that the ranking focuses on the creation/availability of regulatory frameworks themselves rather than on the speed at which permits are acquired or exceptions are given. So even though plenty of work is being done to establish necessary frameworks, drone operators believe that a lot more work is needed regarding the regulatory process to get advanced operations off the ground.

All things considered, however, the UK drone industry is optimistic about the future. The economy in the UK as a whole offers a unique opportunity for the drone industry to thrive, and it has witnessed significant advancements in the use of drones in recent years, particularly in healthcare and delivery. In 2021, there were headlines about BVLOS autonomous deliveries of COVID tests and protective equipment (PPE), and in 2022, the Royal Mail launched its first permanent postal drone delivery service in Scotland. These developments paint a promising picture and solid potential for the future of UK drones.

By leveraging its strengths in services and various industries, the UK can continue to explore the potential of drones in areas such as healthcare, transportation, and infrastructure. With the right support and investment, and by addressing the speed of regulatory processing, the UK has the potential to excel in its use of drone technology.

About the Author

Drone Industry Insights (Droneii) is a market research and consulting firm exclusively focused on commercial drones. It was founded in 2015 in Hamburg, Germany and is now the primary global source for market intelligence on commercial drones.

The research topics covered by Drone Industry Insights range from drone applications (i.e. how drones are used for work) to drone regulation, advanced air mobility (AAM), drone investments, company rankings, and global market trends. The company often provides unique customized insights and forecasts on the development of the global commercial drone market, with data breakdown by industry vertical (e.g., Agriculture, Construction, Energy, etc), by application method (e.g., mapping, spraying, inspections, etc), by Region, and by Country.

Droneii’s customers include Airbus, Boeing, EY, Hexagon, Intel, PwC, Lufthansa, Sony and even the drone giant DJI. It has also been featured in renowned publications such as The New York Times, The Economics, The Wall Street Journal, Harvard Business Review, Bloomberg and The Washington Post among others.

Follow them on Linkedin and learn more about their products and services on their website.

Comments